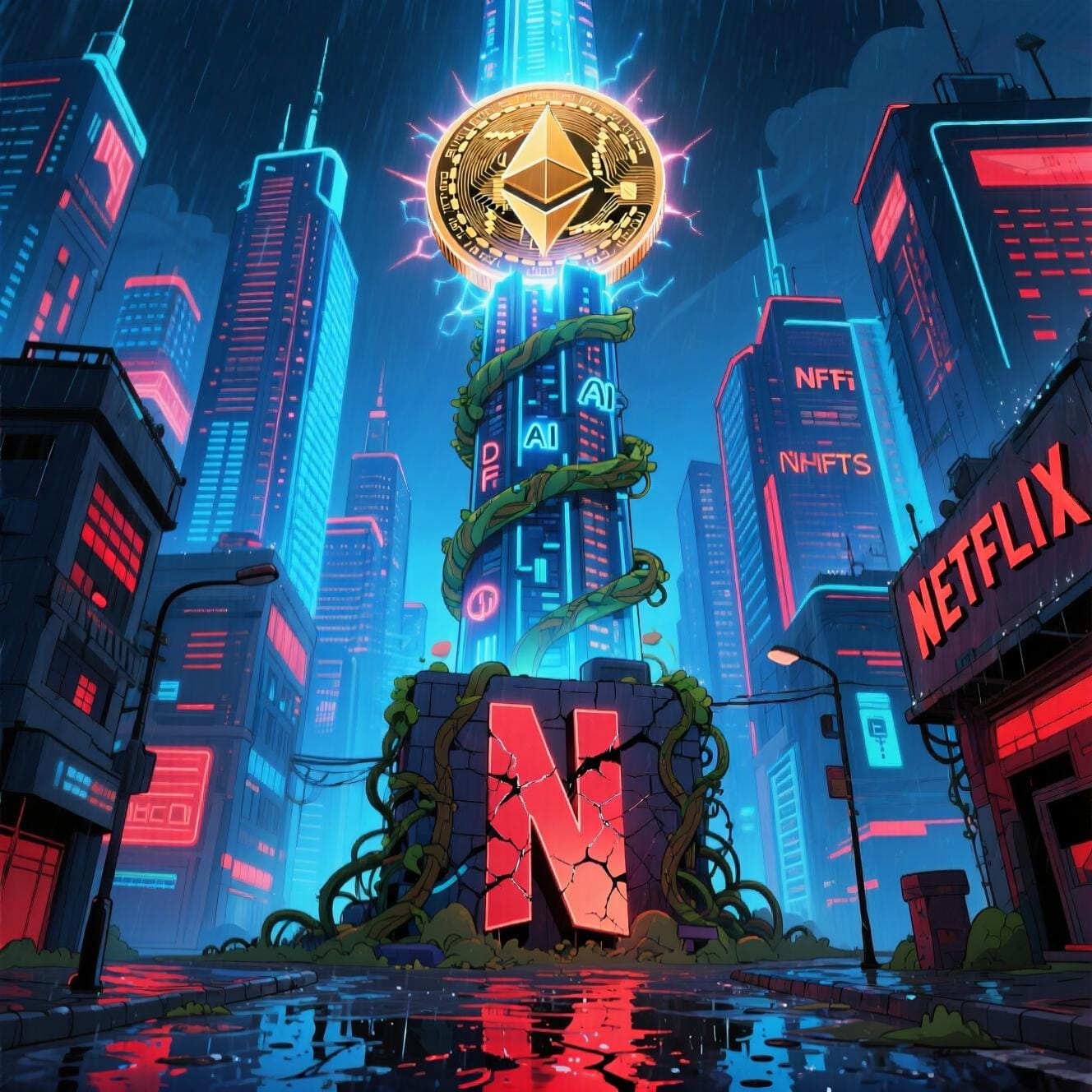

Ethereum Tops Netflix in Market Cap — A Watershed Moment for Crypto’s Mainstream Climb

Ethereum has officially surpassed Netflix in market capitalization, marking a cultural and financial turning point. As DeFi, NFTs, and AI-integrated dApps surge, blockchain is no longer chasing Big Tech—it’s overtaking it.

The New King of Value: Ethereum Edges Past Netflix

In a quiet but seismic shift, Ethereum (ETH) has done what once seemed unthinkable: surpassed Netflix in market capitalization, now valued at over $250 billion—more than the streaming giant that revolutionized entertainment.

This isn’t just a number on a screen. It’s a symbolic handoff—from the era of passive content consumption to one of active, decentralized participation.

Netflix, with its 260 million subscribers and global cultural footprint, built an empire on storytelling. Ethereum is building one on code, ownership, and trustless coordination.

And the market has spoken: infrastructure is worth more than entertainment.

Why This Milestone Matters

Crossing Netflix’s market cap is more than a vanity metric—it reflects a reallocation of investor confidence.

- Netflix has faced slowing subscriber growth, ad-tier friction, and increasing competition from Disney+, Apple, and Amazon.

- Ethereum, meanwhile, is accelerating:

- Dominates 65% of DeFi’s $90B+ Total Value Locked (TVL)

- Hosts over 80% of all NFTs and tokenized assets

- Powers AI agents, on-chain identity, and decentralized social networks like Sapien (SPN)

- Runs on proof-of-stake, using 99.95% less energy than pre-Merge Ethereum

Investors aren’t just betting on price. They’re betting on utility, scalability, and long-term relevance.

A Signal of Mainstream Acceptance

For years, crypto was dismissed as speculative, niche, or even fringe. But when a blockchain protocol outranks a household-name tech company, the narrative shifts.

This milestone signals that:

- Institutions now see ETH as a foundational digital asset

- Developers are choosing Ethereum for its security, ecosystem, and upgrade roadmap

- Regulators can no longer ignore its economic weight

- Retail investors are treating ETH like stock in the future of the internet

It’s not just about market cap—it’s about mindshare.

While Netflix entertains, Ethereum enables:

- DeFi platforms replacing banks

- NFTs redefining digital ownership

- Layer-2 networks scaling global payments

- On-chain AI agents executing autonomous tasks

The value isn’t just financial. It’s architectural.

The Engine Behind the Rise

Ethereum’s ascent didn’t happen overnight. It’s the result of years of grinding development:

- The Merge (2022): Transition to proof-of-stake slashed energy use and improved staking yields

- Dencun Upgrade (2024): Reduced L2 fees by 90%, fueling explosive growth on networks like Arbitrum and Base

- Spot ETH ETFs (2025): Brought institutional capital at scale

- Rise of AI + Blockchain: Projects like Sapien AI and Fetch.ai are running on Ethereum, merging decentralized data with machine intelligence

Meanwhile, stablecoin dominance on Ethereum continues to grow—over 50% of all USDC and DAI are minted on its chain, making it the financial rails of Web3.

Netflix vs. Ethereum: Two Models, Two Futures

| Metric | Netflix | Ethereum |

|---|---|---|

| Market Cap | ~$245B | ~$252B |

| Users | 260M subscribers | ~80M on-chain addresses |

| Revenue Model | Subscriptions & ads | Transaction fees, staking, app royalties |

| Core Value | Content delivery | Trustless computation |

| Innovation Vector | Original shows | Smart contracts, DeFi, AI agents |

Netflix delivers movies. Ethereum delivers a new financial and computational paradigm.

And while one thrives on attention, the other thrives on permissionless innovation.

What’s Next? The Road Beyond Big Tech

If Ethereum can surpass Netflix, what’s next?

- Disney ($180B)? Already behind.

- PayPal ($200B)? Overtaken.

- Visa ($500B)? That’s the next horizon.

With Vitalik Buterin’s vision of 10x L1 throughput and EigenLayer enabling restaked security, Ethereum is evolving from a settlement layer into a modular, high-performance base for the global economy.

This isn’t the peak. It’s the launchpad.