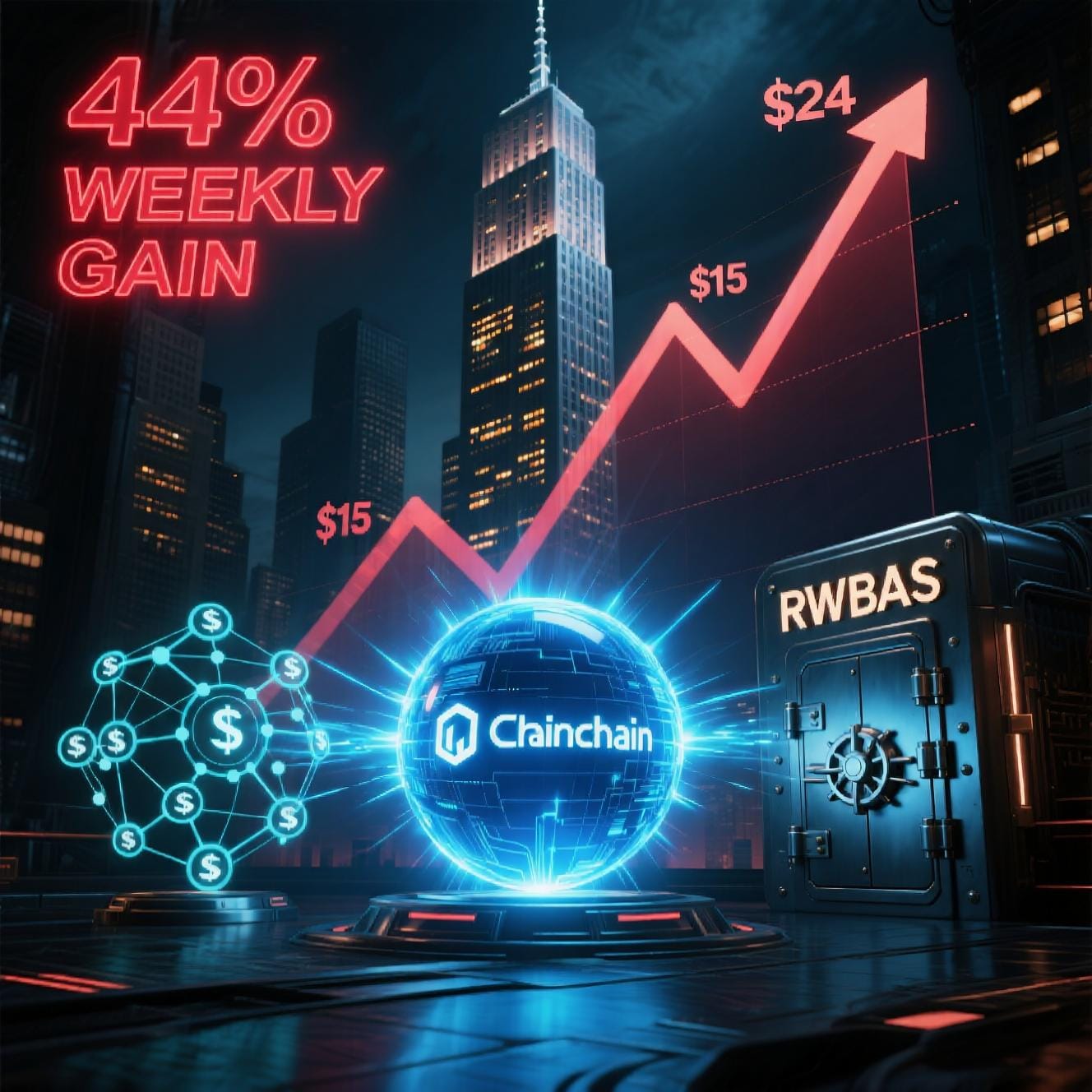

Chainlink Roars Back With 44% Surge — Is ‘Round 2’ Just the Beginning?

Chainlink is back in the spotlight with a 44% weekly gain and a 54% surge over the past month. Traders are calling it the “most obvious large-cap play” of the cycle, fueled by a bullish technical setup and real-world traction — including a major ICE partnership.

The Comeback Kings: Chainlink’s Quiet Reclamation Tour

In a market obsessed with memecoins and flash-in-the-pan narratives, Chainlink (LINK) is doing something quietly revolutionary: it’s working.

After months of flying under the radar, LINK has exploded back into view with a 44% gain in just seven days and a 54% rally over the past 30, climbing to $24.00 at press time. That’s not just momentum — it’s a revaluation.

And the most vocal bulls aren’t retail gamblers. They’re seasoned traders like Johnny (860K+ followers) and Miles Deutscher, who declared:

“LINK might be the most obvious large-cap play for this cycle. And most people will miss it.”

Bold words. But the data backs the hype.

“Round 2” or Just the Warm-Up?

The charts tell a compelling story.

After consolidating for months, LINK broke out with conviction, testing $24.60 — a level that could trigger a cascade of short squeezes. According to CoinGlass, a mere 6.2% move to $25.50 would liquidate $61 million in short positions, potentially fueling a parabolic push.

Santiment confirms the mood: bullish sentiment on LINK is at its highest since February 1, signaling a shift from apathy to anticipation.

Still, perspective matters. Despite the rally, LINK remains 55% below its May 2021 all-time high of $52.88. That gap isn’t a weakness — it’s a magnet. Many traders are holding out for breakeven plays, waiting for 2021-era assets like Stellar (XLM), Hedera (HBAR), and Litecoin (LTC) to reclaim their peaks before exiting.

But Chainlink isn’t just another altcoin hoping for nostalgia. It’s building the plumbing for the next financial era.

Why Chainlink Isn’t Just Riding the Wave — It’s Building the Ocean

The real story isn’t price. It’s adoption.

Chainlink isn’t waiting for institutional money to come to crypto — it’s bringing crypto to institutions.

Recent developments prove it:

- Partnership with Intercontinental Exchange (ICE) — the Fortune 500 parent of the NYSE — to bring FX and precious metals data onchain

- CCIP (Cross-Chain Interoperability Protocol) adoption by major banks and asset managers

- RWA (Real-World Asset) tokenization accelerating, with Nazarov calling it a “capital velocity revolution” for treasuries, real estate, and private credit

As Sergey Nazarov said on May 15:

“Tokenization will unlock trillions by making traditionally illiquid assets programmable, transferable, and globally accessible.”

Chainlink is the oracle layer making that possible. It’s not just a crypto project — it’s the bridge between Wall Street and Web3.

And as stablecoin issuance and onchain finance explode, demand for secure, decentralized data only grows.

The Big Picture: LINK as the Infrastructure King

While memecoins grab headlines, Chainlink is doing what it does best: being essential.

- DeFi relies on its price feeds

- RWA projects trust its oracles

- Enterprises choose its interoperability tools

It’s not flashy. It doesn’t need memes. It just needs time, adoption, and capital flows — all of which are aligning.

Analysts aren’t predicting $50 just because of charts. They’re pricing in structural demand — the kind that doesn’t vanish when hype fades.

Final Word: The Obvious Play That Everyone Might Overlook

In crypto, the best opportunities are often the ones that seem too boring to be revolutionary.

Solana has speed. Ethereum has scale. But Chainlink has inevitability.

It’s the critical infrastructure powering the next phase of finance — one where real-world assets move onchain, and institutions don’t just participate, they lead.

So while traders debate “round 2,” the real question is:

Is this just the first inning of Chainlink’s decade-long play?

With a 44% pop, Fortune 500 ties, and RWA tailwinds at its back, LINK isn’t just back.

It’s quietly becoming too important to ignore.