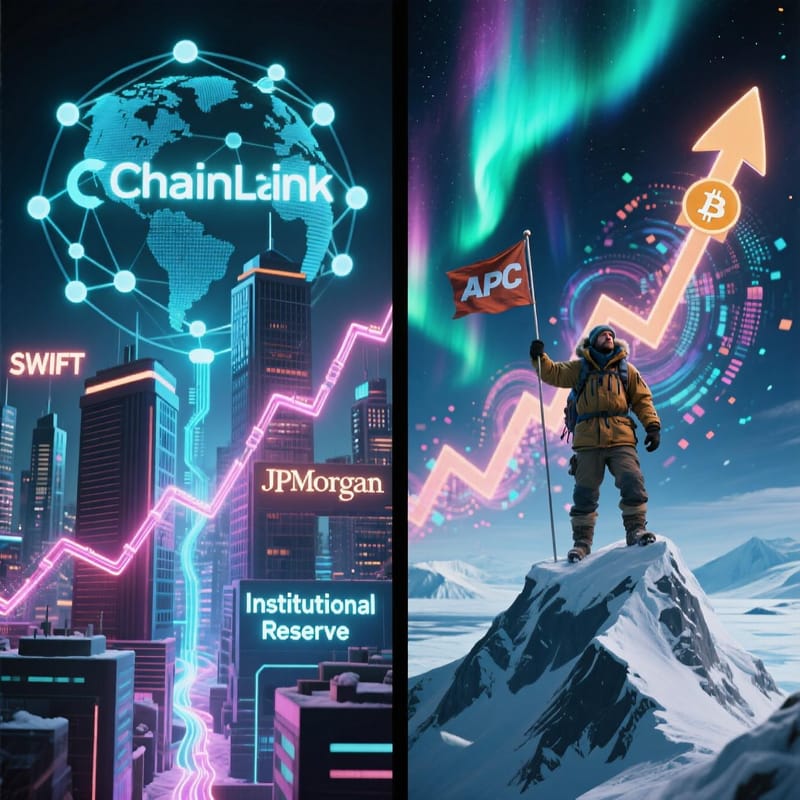

Chainlink Holds 20% Surge Amid Altcoin Shakeout — Can LINK Break $40?

While the broader altcoin market corrects, Chainlink (LINK) is standing strong with a 20% weekly gain and growing institutional traction. As the network surpasses $84 billion in secured DeFi value and eyes a critical reserve update, analysts ask: is LINK poised for a breakout

Chainlink Defies the Downturn

In a market where most altcoins are retreating, Chainlink (LINK) is proving its resilience. Despite a 6.36% pullback to $22.21, the oracle giant has held onto a 41% monthly gain, outperforming peers and reinforcing its status as a blue-chip infrastructure play.

Trading as high as $23.41 on August 14, 2025, LINK has now broken above the $20 weekly resistance—a psychological and technical barrier that held for years. This shift signals growing confidence in Chainlink’s long-term role in blockchain data infrastructure.

The Oracle Dominance Play

Chainlink isn’t just another altcoin—it’s the backbone of real-world data on-chain. With 84% oracle market dominance on Ethereum and over $84 billion in secured DeFi value, it’s the default solution for smart contracts needing price feeds, weather data, or payment confirmations.

But its reach extends far beyond DeFi.

As highlighted by analyst Miles Deutscher, major financial institutions—including SWIFT, JPMorgan, and Mastercard—are already integrating Chainlink to bridge traditional finance with blockchain systems.

This isn’t speculation. It’s enterprise adoption in motion.

Why a Breakout Could Happen

Chainlink’s price action is being driven by more than just hype. A powerful economic flywheel is forming:

- Chainlink Reserve: Network fees and enterprise revenue are converted into LINK and added to the Chainlink Reserve, creating consistent buy pressure.

- Staking: Over 4.32% APR incentivizes holders to lock up tokens, reducing circulating supply and boosting scarcity.

- Usage → Fees → Buybacks: More adoption means more fees, which means more LINK bought and held.

This creates a self-reinforcing cycle where growth directly fuels token value.

Reserve Update Looms, Interest Soars

Investors are on high alert for an imminent Chainlink Reserve update. Currently holding 65,552 LINK at an average cost of $16.83, the reserve’s next deposit could signal renewed confidence from the core team.

At the same time, Google Trends data shows a sharp spike in global search interest for “Chainlink,” indicating growing retail and institutional awareness.

As market commentator Chris Barrett noted, rising search volume often precedes price momentum—especially in infrastructure assets with long-term visibility.

Could LINK Hit $40?

Reaching $40 would require:

- Sustained enterprise adoption

- Continued growth in staking and fee revenue

- A broader altseason rotation into infrastructure plays

If Chainlink can maintain its real-world utility edge and expand into AI data feeds, RWA tokenization, and cross-chain interoperability, that target becomes plausible.

But it won’t happen overnight. This is a fundamentals-driven climb, not a meme-fueled pump.

Meanwhile, Retail Chases Narrative Plays Like Arctic Pablo

While Chainlink builds for the long term, retail investors are flocking to high-conviction, story-driven tokens like Arctic Pablo (APC).

Unlike enterprise-focused oracles, Arctic Pablo thrives on adventure, scarcity, and community:

- Presale at $0.0008 (Stage 36: Horizon Haven)

- 66% APY staking rewards (vested over two months)

- Deflationary model: Weekly burns + all unsold tokens burned post-presale

- Total supply: 221.2 billion APC

- Smart contract:

0x84B742E4514EC8b073005D7Ec0A6d7350F2a9a52(BEP-20) - Roadmap: Q3 2025 exchange listings, platform development, ecosystem expansion

With over $3.3 million raised and growing buzz on Telegram and X, Arctic Pablo is capturing the imagination of the next wave of retail investors.

Final Word: Two Sides of the Same Market

Chainlink represents the infrastructure layer—slow, steady, and essential.

Arctic Pablo represents the narrative layer—fast, viral, and explosive.

One powers the future of finance. The other fuels the fire of adoption.

And in 2025, both are winning.