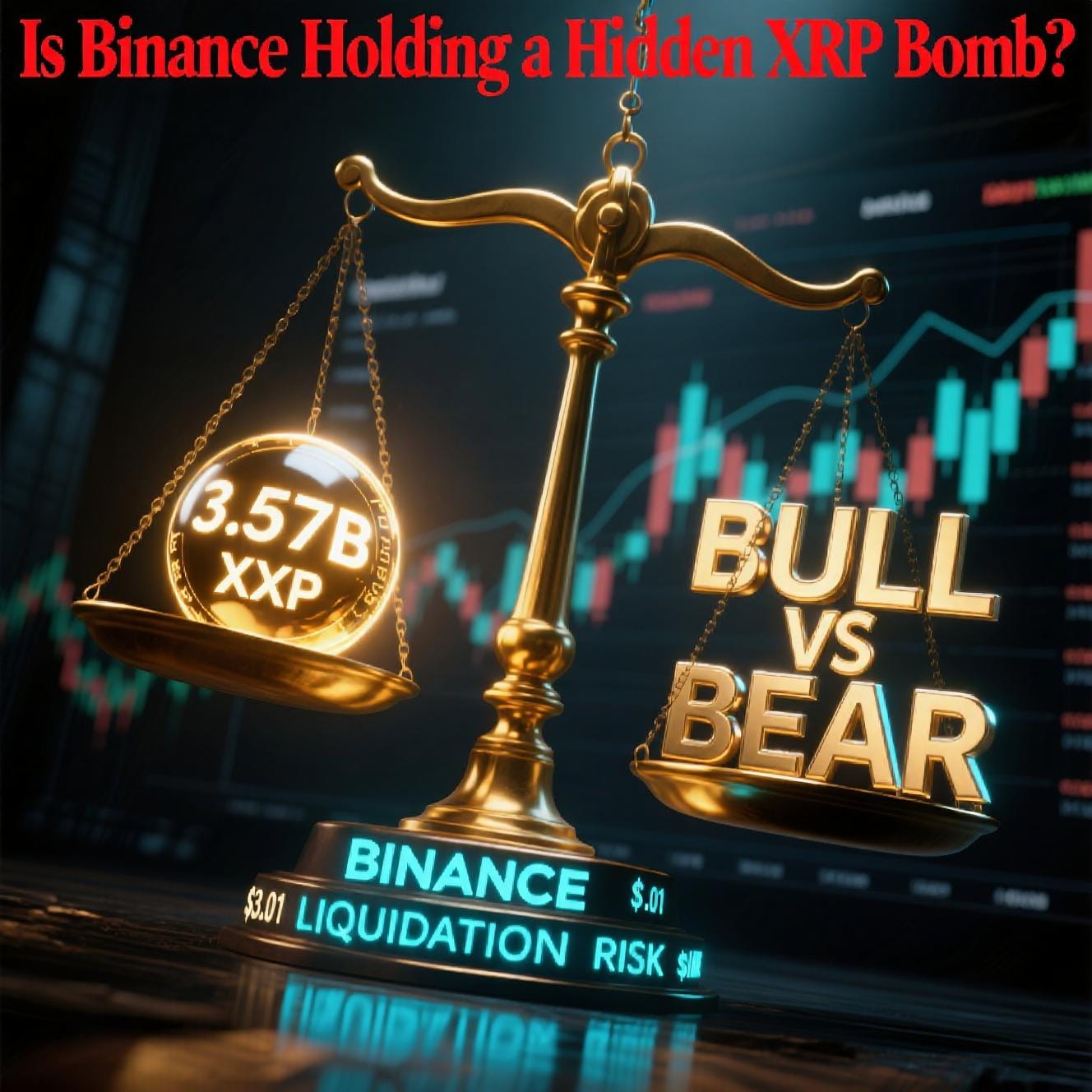

3.57B XRP on Binance: Liquidity Boom or Investor Risk?

A major signal has emerged in the XRP market. Binance’s XRP reserves have surged to an all-time high of 3.57 billion tokens, raising questions about market health and future price direction.

The Binance Reserve Surge: Bullish or Bearish?

The data is clear: 3.57B XRP now sits on Binance, the highest level ever recorded.

- Supply Context:

- 3.57B XRP = ~2.4% of total supply

- Represents $10.7 billion at current prices

- Historical Precedent:

- Large exchange inflows have preceded short-term corrections in the past

- Often linked to whale movements, institutional rebalancing, or ETF preparation

- Counterpoint:

- Outflows from exchanges have consistently exceeded $100 million, indicating net accumulation

- This suggests that while Binance’s reserves grow, more XRP is leaving other exchanges—a bullish net trend

“Not all exchange inflows are sell signals—some are strategic positioning.”

Derivatives Data: Bulls in Control, But Risk Is Rising

The futures market tells a bullish story—with a warning.

- Derivatives Volume: +34.77% to $7.49B (24h)

- Open Interest: $8.19B — growing demand for leveraged positions

- Options Activity:

- Volume ↑ 60%

- Open Interest ↑ 47%

- Long/Short Ratio:

- Binance: 3.44 (bulls dominate)

- OKX: 2.32 (strong long bias)

- Liquidations: $8.61M in 24h

- $7.9M from shorts — bulls are forcing bear exits

While this shows strong upward pressure, it also creates explosive risk. A sudden reversal could trigger a liquidation cascade, especially if the $3.00–$3.05 resistance holds.

Undervalued Signals and Price Structure

Despite volatility, analysts see XRP as undervalued.

- Current Price: $3.01

- Fair Value Zone:

- Technical models show XRP trading in a "red zone" below fair value

- Green zones (fair to overvalued) start at $4.00+

- Elliott Wave Outlook:

- Bull Case: Breakout toward $11–$18

- Bear Case: Range-bound between $1.70–$2.10

- Current price above $3.00 supports the bullish wave structure

- Resistance: $3.05–$3.20 — break above could trigger FOMO buying

XRP’s 7.71% weekly gain confirms strength, but a confirmed breakout is needed to sustain momentum.

Final Takeaway: Risk and Reward in Balance

- ✅ 3.57B XRP on Binance — a potential red flag, but not definitive

- ✅ Strong derivatives activity — bulls in control, shorts getting crushed

- ✅ Net exchange outflows — suggests broader market accumulation

- ✅ Trading below fair value — room for upside if resistance breaks

The truth?

This isn’t just risk or reward—

it’s both.

And in 2025,

the smartest investors don’t fear volatility—they prepare for it.